Many governors have been formulating different plans to reopen schools in the fall.

The Ongoing Debate Over What People Can Drink and What They Are Taxed

There is an ongoing debate over why states should have a stake in what residents are allowed to drink and how much they should be taxed.

California’s Housing Bill Will Plague the State’s Budget for Years

SB 1410 in California plans to let tenants life rent-free and force taxpayers to provide landlord relief.

The Lack of Federal Privacy Policy Causes Inconsistency with Tracing Apps

Many states have adopted contact tracing, but there are concerns with the lack of federal privacy policy.

States Should Cut Spending, Not Raise Taxes

State governments should be focused on cutting spending to offset revenue losses, not raising taxes.

California’s $100 Billion Nightmare High-Speed Rail Project

The California High-Speed Rail Authority has caused a fiscal nightmare for the state.

Congressional Inaction on Internet Sales Tax Creates Adverse Reaction in the States

Congressional inaction and a Supreme Court case has caused problems for how states can impose sales taxes on online sales.

The Ohio Solution for Getting the Country Back to Work

HB 673 will reduce regulatory barriers to help the state recover and reopen from the coronavirus pandemic.

Federal Mandate on Debt Collection Will Not Help Struggling Consumers

Any future coronavirus relief packages must not include a federal “fix” for utilities’ debt collection. Doing so will only add to the intense economic pain with which customers and their families are already coping.

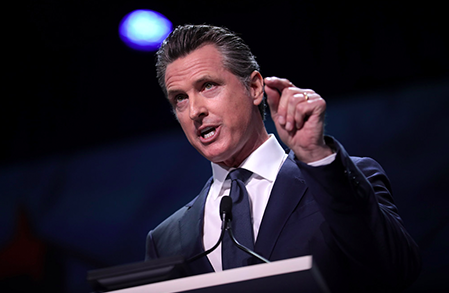

California Legislature Rightfully Criticizes Gov. Newsom for Government Overreach

Members of the California State Legislature have criticized Governor Gavin Newsom for keeping lawmakers in the dark about spending plans.